You know you need a streamlined rewards and recognition program. You’re already managing recognition walls, running to the store and buying gift cards, and tracking your rewards spending on a spreadsheet somewhere. But how do you get started with selecting and budgeting for a program like this?

We’ve outlined three essential best practices you should keep in mind when budgeting for your rewards and recognition program.

1. Plan Your Budget Based on Your Company’s Needs

The first step to budgeting for your rewards and recognition program is to determine what kind of program your company would benefit from the most. Identify your pain points: do your employees need more company-wide recognition? Does your HR team spend too much time managing your manual rewards and recognition solutions? Is your workforce more receptive to tangible rewards, like plaques and company-branded items, or verbal recognition, or both?

According to SHRM’s most recent survey, the most common types of recognition are timely, developed with input from employees, and tied to business outcomes. You can use these factors to determine what kind of program is right for you.

2. Calculate and Allocate Your Budget Before You Buy

After you’ve selected a program, it’s time to organize your expenses, whether it’s through an in-house team or an outsourced accounting firm. But, how much is appropriate? SHRM recommends that HR departments spend at least 1% of payroll on rewards and recognition. Next, outline your budget option and decide how to allocate your funds. The best-run programs tend to include these three costs:

- Cost of service awards

- Cost of peer-to-peer recognition

- Cost of manager-to-peer recognition

Specify which portions of your budget should go to each.

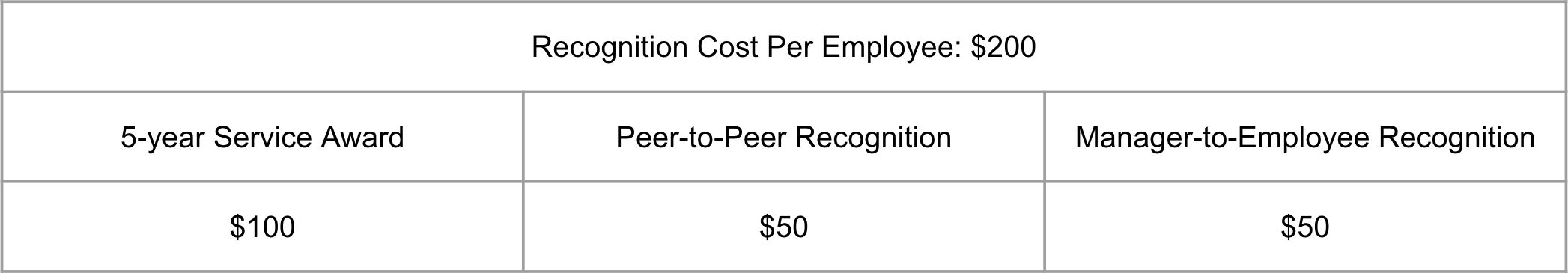

Let’s say you wanted to start conservatively with your program. In that case, we recommend allocating $100-200 per employee. Here is what the cost of recognition looks like for a single employee in the coming year.

The key is to establish your budget and have these numbers in mind before you make a decision, so you can be best informed when choosing the right platform. After fund allocation, you can evaluate whether the distribution is fair and equitable.

We suggest you select a platform that has the flexibility to adjust to your budget. Avoid solutions that require you to determine your budget before you’re ready, purchase rewards points immediately, and prepay for them before you need them. Solutions that can adjust as your budget changes can adapt to fit your company’s specific needs.

3. Distribute Funds for a Variety of Programs

Culture management is an increasingly large workforce challenge. There are so many ways to show recognition, from gift cards and thank-you notes to highlighting accomplishments during meetings. But if recognition isn’t varied enough, it becomes less meaningful (and less effective).

If your company is running several incentivization programs at once — like wellness programs, safety trainings, learning and development programs, and employee referral programs — consider consolidating these programs into a single solution. This makes budgeting for these programs much easier, so you can ensure your employees receive rewards for different behaviors on a single platform. An automated SaaS solution can help consolidate rewards for multiple HR programs into a single location, making budgeting for rewards and incentive programs easier for HR teams.

Learn More

Want to speak with an expert? Get in touch and Fond can help.